With the world’s financial markets making huge losses in September 2011 and with the EU and the US drowning in their debt woes Khilafah.com provides some answers to the most important questions being asked.

The financial crisis that began in 2008 led to a raft measures to stop the onset of a deep recession. In September 2011 the financial markets have again collapsed. Why has the global economy failed to recover?

The real estate boom for the last decade fundamentally drove the global economy and the world’s largest economies. The finance for purchasing property, household appliances and construction all were stimulated due to this boom. The fuel for the housing boom was the banking industry and its most important product – debt.

The financial industry created many products, which indebted many in the West. The banking industry in the West even lent money to those who in reality had little ability of ever making the repayments.

By late 2007 the number of defaults as well as the number of subprime companies collapsing led to the beginning of the end of the boom. This particular crisis is different to other crises in that it affected the banking industry. As banks collect deposits from savers and then lend to those who wish to start business, banks play a central role in distributing wealth across the economy. A collapse in the banking industry would completely halt economic activity

Unrestricted debt – this is money that is lent with little restrictions as was the case with subprime loans has a massive impact on the economy. It means money can be easily acquired to make risky investments. This is why Western economic history is littered with examples of bubbles, collapses and recessions.

The driving engine for the boom was the financial industry which created a bubble in real estate. The driving engine crashed and ever since the West has been unable to kick start the engine or replace it with another boom or another sector

Why have all the solutions failed?

An analysis of the solutions to date show that none of the factors that caused the crisis have been dealt with, in fact Western governments have attempted to keep Capitalism afloat at all costs.

Initially Western government’s attempted to solve the crisis with a combination of stimulus plans and nationalisations of failed institutes. In the UK Northern Rock a regional bank was taken over by the British government, whilst other banks were provided with bailouts, similar actions took place in Germany, France and the US. Whilst this stopped the banks from collapsing it in no way dealt with the issue of economic growth and the negative sentiment regarding the future of the global economy. Many criticised such actions as bankers were being bailed out whilst a recession in Western societies grew deeper.

At the peak of the economic crisis many Western states developed Stimulus packages in order to save their economies from collapse, the most infamous being the US $1.2 trillion stimulus package in 2008. However any stimulus was always a high-octane boost and a temporary measure. They were designed to kick-start stalled economies, not to fuel sustained economic growth. Government initiatives such as Car Scrappage schemes as seen in most nations, the reduction in the general sales tax in the UK and tax credits for first-time home buyers as seen in the US and France, all were attempts to kick start economic growth, as these programs ended, so did their contribution to the global economy.

Western governments also resorted to Quantitative Easing (QE), a new development which was an electronic method of printing money. This is an unconventional policy used by central banks to stimulate the national economy when conventional policy has failed. A central bank implements quantitative easing by buying financial assets to inject a pre-determined quantity of money into the economy. This is achieved by purchasing financial assets from banks with new electronically created money. This action increases the reserves of banks.

The intention here was to shore up banks and their balance sheets in the hope they would begin lending and thus stimulate the economy. In practice however all of this led to inflation. As the economy stagnated this excess money led to prices to rise i.e. stagflation

All of these solutions have not dealt with debt fuelled growth, whilst debt caused the problem more debt was thrown at it, Western governments attempted to treat the patient with the disease itself.

Why are the world’s largest economies in so much debt?

|

World GDP |

|

GDP, 2008 |

Total debt |

|

Ranking, 2008 |

Country |

$ trillion |

$ trillion |

|

1 |

US |

14.4 |

41.8 |

|

6 |

UK |

2.1 |

10.1 |

|

4 |

Germany |

2.9 |

7.9 |

|

7 |

France |

2.1 |

6.5 |

|

9 |

Italy |

1.9 |

5.7 |

Of the largest economies in the world, the US, UK, Germany, France and Italy all have high debt levels. The growth of these economies is built on governments borrowing money to stimulate projects, create jobs, increase demand for products and hence create growth. A lot of this debt has been used to create wealth. However, it seems that there hasn’t been a structured plan to pay this debt back, and this is what is causing a lot of the problems we are seeing today, with deficit and debt levels seemingly out of control. Third world debt pales into insignificance when compared to the debt of Western nations. US debt is a staggering $40 trillion whilst total third word debt is a relative meagre $1.3 trillion.

Using debt to grow is a short cut to economic growth, all other methods would require large government investment and although much more stable would take time for the effects to trickle through the economy. Examples of this would be investing in research and development, education or undertaking infrastructure projects. With most Western government election cycles are 4 years, short cuts to growth is usually the path taken, this is why most of the Western states have debts that far exceed what the economy produces.

Why can’t the debt just be written off?

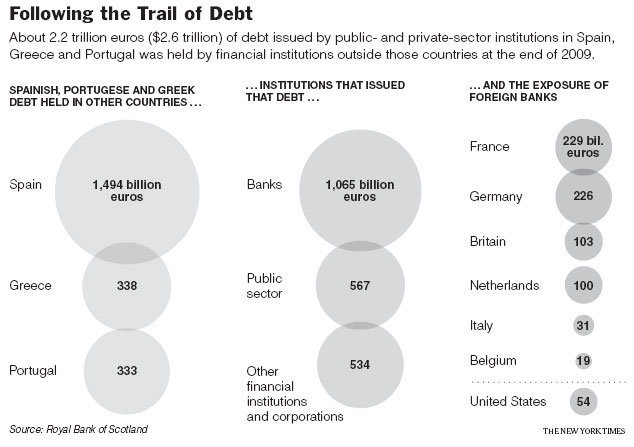

At the height of the economic crisis Western banks combined (collateralized) various loans creating new products out of them. Each collateralized product was a combination of risky debts and more stable debt, fundamentally each product was a number of income streams. The problem here is who holds the actual debts, who’s balance sheets they are on, who is owed the debts and how much the total bad debt situation is, all of this is a mystery. Estimates have been made as the chart shows. The chart shows that most of the debt in Europe is held by France, Germany and Britain, i.e. they are owed most of the debt. If the PIIGS economies – Portugal, Italy, Ireland Greece, Spain default on their debts, or come to a deal to write them off, then France Germany and Britain essentially lose out on the money they are owed. This is the reason why for the moment, writing of the debt off is a no go. Therefore this option is a political issue rather than an economic matter. The EU leaders France, Britain and Germany have imposed severe conditions on Greece to ensure its debts are prioritised over all other expenditure. This is why many Greeks have been demonstrating on the streets as public sector cuts, redundancies, cut backs are all being undertaken by the Greek government to fulfil the wishes of the EU’s larger nations. This debt cannot be written off due to political considerations of France, Britain and Germany

here is who holds the actual debts, who’s balance sheets they are on, who is owed the debts and how much the total bad debt situation is, all of this is a mystery. Estimates have been made as the chart shows. The chart shows that most of the debt in Europe is held by France, Germany and Britain, i.e. they are owed most of the debt. If the PIIGS economies – Portugal, Italy, Ireland Greece, Spain default on their debts, or come to a deal to write them off, then France Germany and Britain essentially lose out on the money they are owed. This is the reason why for the moment, writing of the debt off is a no go. Therefore this option is a political issue rather than an economic matter. The EU leaders France, Britain and Germany have imposed severe conditions on Greece to ensure its debts are prioritised over all other expenditure. This is why many Greeks have been demonstrating on the streets as public sector cuts, redundancies, cut backs are all being undertaken by the Greek government to fulfil the wishes of the EU’s larger nations. This debt cannot be written off due to political considerations of France, Britain and Germany

Is America on the verge of Bankruptcy?

The debacle that took place in the US between the Republicans and Democrats in July 2011 was about increasing the debt ceiling – the amount the government can borrow. The US government needs the permission of Congress to raise the ceiling on the amount of money it can borrow. If Congress didn’t grant an increase then Obama’s regime would have hit the debt ceiling limit and would have had difficulties in meeting its debt repayments. Ironically the US borrows to repay previous debts. This is not the first time the US has been forced to increase its debt ceiling. In February 2010 a similar fanfare took place. This rather flexible “ceiling” has been raised 33 times since it first was raised over the $1 trillion level in September 1981. Noble Laureate Paul Krugman outlined the fanfare: “The facts of the crisis over the debt ceiling aren’t complicated. Republicans have, in effect, taken America hostage, threatening to undermine the economy and disrupt the essential business of government unless they get policy concessions they would never have been able to enact through legislation. And Democrats – who would have been justified in rejecting this extortion altogether – have, in fact, gone a long way toward meeting those Republican demands.” And, oh yes, the President had some big skin in the game.”

|

Debt |

$ trillion |

|

National |

14.3 |

|

Consumer |

2.4 |

|

Mortgage |

13.2 |

|

Company |

20.8 |

|

Total |

50.7 |

The debt impasse in reality concealed America’s bankruptcy. America’s fundamental problem is that it is drowning in a sea of debt. The US economy generates around $14 trillion annually, however the national debt – the money the central and federal government owes to the US public and the world through the bonds (or IOU’s) they have issued – stands at $14.3 trillion. Interest payments on this debt was $414 billion alone in 2010. Those who are expecting to be repaid by the US one day include governments such as China, companies and banks. This debt emanates from US citizenry’s huge appetite for imports and credit cards and as a result consumer debt stands at $2.4 trillion. The desire by American’s to own their own homes has resulted in mortgage debts of $13.2 trillion. The debts of US companies amounts to $20.8 trillion. This makes the US indebted to the tune of $50.7 trillion – more than the combined economies of Japan, China Britain, Germany, France, Brazil, Canada and Italy twice over.

With so much debt the US should really be receiving multiple downgrades and should have been in a state of bankruptcy a long time ago. It is able to get away with this as it’s the worlds superpower. However its super power status is also fading as the US faces challenges form Russia and China in areas of the world which the US has long dominated. On paper the US is bankrupt as it cannot feasibly repay its debts. The issue currently is no nation in the world has taken advantage of this.

What happened to Greece?

Greece the cradle of Western civilisation joined the Euro zone in 2001. By becoming a member of the Euro zone Greece’s credit rating was considered the same as Europe’s heavy weights such as France and Germany as they were all now part of the same union. This gave Greece access to finance that it would otherwise not be privileged to and it also sold Bonds at low rates of interest. Rather then wait until it had enough money to fund its expenditure Greece decided it would rather borrow the money today and as taxes come in over the years it would repay the debt.

Due to this a boom in the Greek economy took place, from 2000 – 2007 Greece was the fasted growing economy in the Euro zone as capital flooded the country. Successive Greek governments went on spending spree’s, creating in turn many public sector jobs, new pension plans and many other social benefits. The spending addiction included high-profile projects such as the 2004 Athens Olympics, which went well over budget.

The problem Greece faces is that it has accumulated debts of €300 billion, with an economy of only €240 billion and a government budget of only €91 billion. Greece’s debt is more then the whole economy put together and the Greece government has to repay €53 billion in 2011 alone. This situation is not sustainable as Greece does not have an economy that produces sufficient wealth that can repay such debt after domestic expenditures have been met.

The problem with deficit spending and debt fuelled growth is at some point the debt will have to be repaid. Most government do not worry about deadline day as it will always be in a future term with another government, hence its their problem to deal with. For Greece that last decades debt is now due for repayment, but the kitty is sitting empty.

Will the EU collapse?

The European Union now has a growing list of states that are considered the sick men of Europe. A European attempt at defending themselves against a deep recession has now created a new crisis of unsustainable and un-serviceable sovereign debt. Much of this can be attributed to stimulus packages passed by European governments in order to blunt the effects of the economic crisis, especially in preventing massive layoffs. Europe’s heavyweights spent massively on stimulation packages. This led to debt levels skyrocketing across the Euro zone, but especially in the PIIGS countries.

The Euro was hailed as the replacement to the dollar. However the financial crisis has brought a damning fact to the surface, whilst countries such as France and Germany will be able to service their debts, nearly all of the other eurozone nations have pitiful financial situations where they have spent well beyond their means and now when it has come to repay this debt the feasibility of meeting the regular monthly repayments is looking impossible. The issue the Euro has faced from its inception is the fact that all the eurozone nations have very divergent economies and hence the strength of the euro is in the strength of the Eurozone economies and only as strong as the weakest link.

When the economic problems were confined to small countries such as Greece and Ireland, it was assumed that any fallout could be contained. Now however the crisis has threatened to engulf nearly all of Europe. Italy which is the eurozone’s third-largest economy and the world’s fourth-biggest debtor is also reaching breaking point.

It is unlikely the EU will collapse as it is a political union and nations such as France and Germany have invested heavily in it and would defend it. Germany as an example is the leader of the European Union bailout found, the European Financial Stability Facility (EFSF) and is using it to reorganise the whole EU, to ensure such a situation cannot happen again. Due to the investment made by Europe’s heavyweights it is more likely they will defend the EU rather then let it collapse. For the moment the crisis is economic, it has not spread to the political arena. This is significant as the EU is a political union.

Will the global economy go into recession again (double-dip recession) and will it ever recover?

All attempts at creating economic growth have now been tried and have failed. The stimulus packages have driven artificial growth, whilst Western nations have not provided such a leg up for their economies for some time the free market has been unable to grow on its own in any sustainable way and has brought the spectre of double dip recession ever closer. It is difficult to see where economic growth will come from and for this reason the global economy will in all likelihood go into recession again. The global economy and especially the West will go through a long period of instability which will create more unemployment and riots as has been seen in Greece. There are really only two outcomes which may eventually lead to economic recovery. The first is the global economy goes into recession and possibly a depression, prices hit rock bottom and this leads to property, loans and commodity prices being seen as cheap and this kick starts economic growth.

The second possibility is China bails out the West. China’s vast trade and financial surpluses are causally linked to the unsustainably large debts of the US, UK and a swathe of the eurozone. It would be in their interests to bail out the West. This would also mean the Western world will have to accept Chinese global leadership. Here the issue is not whether the West will accept such a bailout but rather will China pursue such a policy.