Barack Obama in an article for the Washington Post laid out the economic challenges the world’s largest economy faces: “By now, it’s clear to everyone that we have inherited an economic crisis as deep and dire as any since the days of the Great Depression. Millions of jobs that Americans relied on just a year ago are gone; millions more of the nest eggs they worked so hard to build have vanished. People everywhere are worried about what tomorrow will bring.”

Barack Obama in an article for the Washington Post laid out the economic challenges the world’s largest economy faces: “By now, it’s clear to everyone that we have inherited an economic crisis as deep and dire as any since the days of the Great Depression. Millions of jobs that Americans relied on just a year ago are gone; millions more of the nest eggs they worked so hard to build have vanished. People everywhere are worried about what tomorrow will bring.”

The incoming president has laid the blame for the crisis firmly on the Bush administration and in the run up to the elections he laid out his recovery plan, which he reiterated again in the Washington Post: “What Americans expect from Washington is action that matches the sense of urgency they feel in their daily lives – action that’s swift, bold and wise enough for us to climb out of this crisis. If nothing is done, this recession might linger for years.”

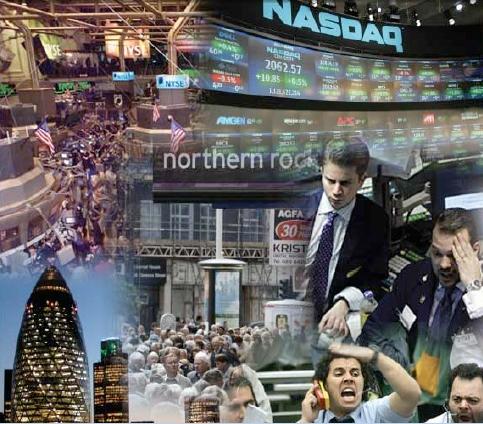

The global credit crisis has had a variety of bailout packages thrown at it, but it continues to worsen. Companies which were established in the 19th century are declaring bankruptcy one after another as well as many high street brands. Why have Western governments been unable to stop the global economy from sinking into recession? How are governments attempting to solve the economic crisis? Will these measures work? Will the recession turn into a depression?

The answers to such questions require us to understand the nature of capitalist economies:

1. The US economy is driven almost entirely by consumption. 80% of America’s $14 trillion economy is service based. Wholesale trade, the manufacturing of consumer goods and retail comprises 65% of the services sector. The US over the last 30 years has become reliant on consumption and today is the world’s largest consumer of many items.

The events of 9/11 and with the prospects of a recession in the US, the Federal Reserve in cahoots with the White House reduced interest rates to virtually 0%. This made debt an attractive way to fund spending with little interest to be repaid. This also meant monthly mortgage repayments had little interest added to them.

This housing bubble is what drove the US economy since 9/11 as a large chunk of consumer spending went on the purchase of homes. Housing in turn fuelled appliance sales, home furnishings and construction. In 1940 44% of US citizens owned their own homes, by 1960 62% of Americans owned their homes. Currently nearly 70% of all housing is owned by its constituents. The increase in home ownership resulted in more and more US citizens becoming indebted where US household debt stood at $11.4 trillion in 2006.

When the housing bubble burst due to the huge increase in defaults, this essentially brought to an end the engine that drove the US economy for the last decade. This spread to the rest of the world as the US is the main engine for economic activity for the world economy. Its huge level of consumption is responsible for most of the growth being experienced by China and India. With only 5% of the world’s population the US consumes 25% of the world’s oil, and imports 9% of all goods manufactured outside its borders.

2. Britain also faced a similar problem to the US. The British economy was driven entirely by three sectors – finance, housing and the public sector. Between them, they employed 33% of the workforce but accounted for 120% of employment growth. In other words all the other parts of the British economy have, in aggregate, been shrinking during those boom years.

Britain’s finance sector contributes £344 billion a year to the economy and is seen as an attractive destination for international finance due to a mixture of unique institutions, little regulation and a highly skilled workforce. The influence of the financial sector in the British economy led to much speculative wealth finding its way to the housing market. Banks fuelled the housing bubble by making borrowing extremely accessible, due to a buoyant housing market, lending up to 75% of the value of property in 2003 to 85% in 2007 – at the height of the bubble. Such actions by the banks clearly show that banks were very confident that prices would continue to rise. The last decade also saw the public sector grow by an average of 10% dwarfing the private sector in job creation.

Britain reached a point in 2007 where the total UK personal debt was £1.4 trillion, 81% of this was mortgage lending. But the economy was only worth £1.3 trillion. The debt that the nation accumulated was actually more than what the economy could generate.

By 2008 all three of the British economy’s driving engines ran out of petrol. The losses incurred by UK high street banks due to the US sub-prime crisis resulted in banks halting lending to each other and bringing to a halt all lending to the public, effectively bursting the British housing bubble. It also brought British high street bank Northern Rock to its knees.

There have been only two approaches to solving the economic crisis. Firstly, government intervention in the free market by providing bailouts in the hope of containing the crisis and secondly, through socialist state intervention where governments nationalised and took ownership of private companies.

The US government intervened in the economy on an unprecedented scale in an attempt to shore up the economy in 2008. The Bush administration presented congress with the economic stabilization plan in October 2008. The $750 billion bailout package was designed to purchase distressed assets, especially mortgage-backed securities and make capital injections into banks who found themselves with huge worthless debt.

Just the month before, the US government nationalized Fannie Mae and Freddie Mac the large US intermediary which held over $5 trillion in toxic debt. At the same time in order to halt the shrinking US economy the Bush administration cut interest rates and gave tax rebates to encourage spending, hoping this would stimulate the economy.

The US government stood by when Lehman brothers and Bear Stearns were on the verge of bankruptcy but showed its socialist claws and took AIG, the world’s largest insurer, into public ownership when it could not find a buyer and it was on the verge of declaring bankruptcy.

All these attempts tried in some way to protect the banking sector, as any collapse in banking would lead to the second great depression. All of these measures failed as the crisis began to spread beyond the financial sector and into the real economy. The US government was forced to intervene in the free economy as three of America’s iconic automotive brands General Motors, Ford Inc and Chrysler were all on the verge of bankruptcy. The effect of such companies closing on the US economy and Detroit would have been almost apocalyptic and after Congress rejected an initial bailout for the companies President Bush provided them with a bailout package of $17.4 billion.

Obama

Barack Obama’s economic stimulus package of $900 billion is confirmation that all the previous bailouts have failed to halt the slide in the US economy. Western countries have all attempted one bailout after another and stimulation package after another to stimulate the economy. They have continued in their attempts to solve the problem through the same failed solution, it is the same as throwing fuel on fire in the hope that it will extinguish. Britain has also attempted, as the US did, in removing and reducing all obstacles to spending in the hope that the economy will kick start. However after reducing taxes and further bailouts for banks, the economy is officially in recession with all signs pointing towards the recession getting even worse.

Obama in his article for the Washington post outlined his strategy when attempting to justify his mammoth economic give away: “This plan is more than a prescription for short-term spending – it’s a strategy for America’s long-term growth and opportunity in areas such as renewable energy, healthcare and education. And it’s a strategy that will be implemented with unprecedented transparency and accountability, so Americans know where their tax dollars are going and how they are spent.” In essence he will attempt to replace the real estate bubble that drove the economy for the last decade with another bubble. He will throw money at renewable energy where much doubts exists about the applicability of such technology. Health care and education make up such a small portion of the US economy it is impossible for them to replace the real estate bubble.

Western governments are in no way attempting to deal with the underlying problem. They continue to cover the cracks created by failing banks and high street retailers by throwing more money at them. The bailouts received by US banks have been used to shore up their own losses with no plans to lend to the public or other banks. Hence the various bailouts have been useless.

The fundamental problem is what Capitalism attempts to achieve with the economy – perpetual economic growth. Western governments have attempted one after another to stimulate spending in the hope that the economy will be kick started. But it was consumer spending through accumulating debt that created the original problem. Western governments are attempting to cure the patient with the disease itself.

Such measures have already failed and have had disastrous results. The Northern Europe states of Latvia, Iceland, Estonia and Ireland were long considered tiger economies, with Latvia long considered the Baltic tiger. The very policies that allowed the European tigers to grow at a rate of 12% in 2006 are also causing them to contract violently by a projected 10% this year. The Latvian, economy has shrunk more sharply than any other country in the EU, and the government is teetering on the brink of collapse. For weeks the Latvian capital has been rocked by protests, including a full-blown, cobblestone-hurling riot on 13 January. Money, freed of all barriers, flows out as quickly as it flows in, in a free market economy. This was the painful lessons the Tiger economies of South East Asia learnt the hard way a decade ago. The Iceland government has already fallen; it is the first government to have fallen as a result of the credit crunch.

Global Depression 2

It is difficult to see how the world economy will be stimulated. The US is finding consumer spending drastically falling as more and more citizens sit on debt they cannot afford to repay. In Britain the financial sector, long the symbol of London, is losing staff almost weekly. There is no sector in Britain remotely large enough to replace the financial sector. Any British politician with ideas of returning to Britain’s industrial era will find the city, which funds both Labour and the Conservative parties, standing in their way. They will also find that the skills necessary for such radical change left the British Isles a generation ago. This is why it is very likely the recession will turn into a pro-longed deep recession. The US got out of the great depression by mobilising for World War II. The US could attempt through rearmament once again to get itself out of this predicament, however the US is marred in two wars were it continues to bleed to death, it is difficult to envisage the US expanding its theatre of war.

Conclusion

As the world economy goes into recession every Capitalist value has been thrown out of the window in an attempt to stop the slide of the world economy. Whilst the Western world for years through the IMF and World Bank imposed unregulated free markets upon the developing world, when their own economies fell into trouble they have become even more Socialist and intervened on an unprecedented scale.

Both the US and Britain actually have no solution to the crisis. This is why each bailout package is labelled as the last, only for another bailout to then be prepared. They are trying to cure the patient with the virus itself. As the recession deepens this will lead to a fall in investment across the economy and a fall in the price of goods and assets. Once this scenario reaches rock bottom some spending is possible due to the rock bottom price of goods and assets, this in turn should re-stimulate the world economy and end the deep and long recession. The problem is until this point is reached, which is impossible to predict, the world economy will continue to teeter on the brink of collapse.