"The rise of "sovereign wealth funds" signals the end of the neo-liberal model and challenges western states and financial institutions to develop a coherent and long-term response"

Free market ideologues have a new obsession – ‘sovereign wealth funds,' those state-backed investment bodies whose accumulating assets are roaming the globe in search of businesses to invest in, partner and in some cases achieve political ends.

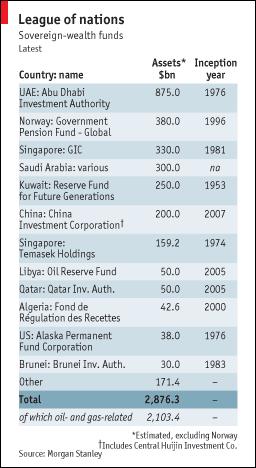

Such funds continue to accumulate huge wealth especially with the recent skyrocketing oil prices, but they hit the headlines with the collapse of the US housing market. In January 2008 the governments of Singapore, Kuwait and South Korea provided the $21 billion lifeline to Citigroup and Merrill Lynch, two banks that have lost fortunes in America's credit crisis. It was not the first time either was bailed out by them. Since the sub-prime-mortgage fiasco unfolded in the summer of 2007, such funds have gambled almost $69 billion on acquiring the rich world's biggest investment banks (far more than usually goes the other way in an emerging-markets crisis). With as much as $2.9 trillion to invest, the funds' horizons go beyond finance to telecoms and technology companies, casino operators, even aerospace. But it is in banking where they have arrived most spectacularly. They have deftly played the role of saviour just when Western banks have been exposed as the Achilles heel of the global financial system.

Although sovereign-wealth funds hold a bare 2% of the assets traded throughout the world, they are growing fast, and are at least as big as the global hedge-fund industry. But, unlike hedge funds, sovereign-wealth funds are not necessarily driven by the pressures of profit and loss. Most do not even bother to reveal what their goals are-let alone their investments. The motives of the sovereign moneymen are considered to be sinister, stifling competition; protecting national champions; engaging, even, in geopolitical troublemaking. Despite their disruptive market power, their managers have little accountability to regulators, shareholders or voters.

Western Fears

The rise of sovereign wealth funds has panicked the world's free market ideologues into defensive responses. An attempt was made at the January 2008 World Economic Forum conference in Davos to negotiate a code of conduct, stricter disclosure requirements and a proposed code of practice. Such proposals were shrugged aside with some SWF managers even commenting if the US wants their banks bailed out from the brink of bankruptcy.

Western fears essentially lie in the fact in the free market for the first time foreign institutes are king. SWF pool large assets and are forecasted to expand in size and importance, so does its potential impact on various asset markets. The Western world also worry that foreign investment by sovereign wealth funds raises national security concerns because the purpose of the investment might be to secure control of strategically-important industries for political rather than financial gain. These concerns have led the EU to reconsider whether to allow its members to use ‘golden shares' to block certain foreign acquisitions. Sovereign wealth funds are guaranteed to make profits as they were all created from foreign exchange reserves and Oil receipts, this makes them a distinct and potentially valuable tool for achieving certain public policy and macroeconomic goals.

Western Hypocrisy

The EU is trying to force SWFs annually to declare the origin and disposal of their assets; to abstain from using investments for political purposes; and to make their management structures transparent. The EU and western governments in general, are in no position to lecture the rest of the world on correct behaviour in such matters. The European Union itself proclaims open markets yet practices protection in agriculture and significant areas of European trade and industry including airlines. France and Germany's gas and electricity giants are considered national interests and given extensive protection.

The "good practice" now recommended to the SWFs – of not using their economic power for political purposes is something Western states have been doing from the very birth of free markets – The East India company is the best example. The economy and state interest have all, permeated the international market for as long as it has existed; the policy of sanctions against Cuba by the United States or Iran by the United Nations are current examples, while the history of oil companies in Latin America or the Middle East prove the private sector and state are two sides of the same coin.

The Gulf States remain – for all the superhighways, skyscrapers, knowledge cities and glitzy conferences – controlled by secretive ruling families whose members regard the state, and its revenue, as theirs. The minister of finance is, in effect, the private accountant of the ruler. No-one knows what the state's (or ruler's) income is. The West have no problem in dealing with Saudi Arabia or placing troops in South Korea, but have concerns when foreign funds cross borders which for once are not from Western companies.

Treachery of Muslim rulers

The UAE, Kuwait, Qatar and Saudi Arabia are the largest funds in the world; there accumulation of oil wealth for the last 100 years has resulted in immense wealth flowing into such countries. Whilst the Gulf States have developed their economies into glitzy shopping islands, Saudi Arabia remains an underdeveloped poverty stricken nation. Rather then develop their own economy and industrialise the rulers in these countries continue to bail out Western companies and buy US treasury bonds. In essence such nations take the money of the West and then give it back to them.

China's investment corporation is an extension of Chinese foreign policy, established with the intent of utilising China's $1.2 trillion reserves for the benefit of the state. It has engaged in building influence for the government by buying up significant stakes in companies that have influence in western governments, airline companies and has targeted firms that have heavily invested in China. The investments would help the government to influence the policies of multinational companies and to protect China's interests in the international arena. It ensures China has a secure supply chain of energy resources and strategic resources.

Whilst China utilises such funds for the development of its nation the Muslim ruler's waste money in US government bonds instead of developing an independent industrial economy. They could even develop the Muslim world and link the Muslim ummah by development projects which will build the infrastructure necessary for future unification. Although discussion has centered on the amount of wealth such funds have, it also exposes the short sightedness of the rulers and their inability to look beyond Western financial markets. It exposes the fact that although Allah (swt) has bestowed the Muslim world with immense natural wealth, the rulers continue to plunder such wealth, whilst the Muslim ummah drowns in poverty.

Major Sovereign wealth funds

Abu Dhabi Investment Authority

Size: $875 billion

Major investment: Citigroup $7.5 billion

History: The Abu Dhabi Investment Authority (ADIA) is the investment arm of Abu Dhabi, the largest oil producer of the seven city-states that constitute the United Arab Emirates.

It was established in 1976, employs about 1,400 people and has investments in banking and industrial businesses throughout the Middle East. It was modelled on Singapore's national investment fund and is the largest sovereign wealth fund in the world.

Dubai International Capital

Size: €6 billion (estimate)

Major investments: "Substantial stake" in HSBC.

History: Dubai International Capital, formed in 2004, is owned by Dubai's ruler, Sheikh Mohammed bin Rashid Al Maktoum. As well as its stake in HSBC, the fund has several significant holdings in household names such as Travelodge, Sony and DaimierChrysler. In 2005 it bought Tussauds Group for £800 million but later sold 80 per cent of the group. It is also famous for its failed bid for Liverpool Football Club in 2006. The club opted for American investors.

DIC's Global Strategic Equities Fund took a stake in HSBC in May, but the size of the purchase was not disclosed, because it did not exceed 3 per cent.

GIC

Size: $330 billion

Major investments: £4.8 billion stake in UBS

History: GIC, the Singaporean government investment arm that has come to UBS's aid, was founded in 1982 to manage the city-state's swelling foreign reserves. With a reputation for maintaining a low profile, it only goes as far to say it manages assets of "more than $100 billion" (£50.4 billion).

Analysts say that dramatically undershoots its real value and estimate its true size as as much as $330 billion. It has delivered an average annual return of 9.5 per cent in dollar terms over the past quarter of a century.

China Investment Corporation

Size: $200 billion in Assets

Major investments: Blackstone $3 billion

History: One of the youngest of the major sovereign wealth funds. It was set up in October after the acquisition of an investment arm of the People's Bank of China, the central bank. CIC is in charge of investing China's vast foreign exchange reserves and is thought to have about $2 trillion at its disposal.

Kuwait Investment Authority (KIA)

Size: $250 in Assets

Major Investments: Citigroup

History: Kuwait's sovereign wealth fund specializes in local and foreign investment. It was founded to manage the funds of the Kuwaiti Government in light of financial surpluses after the discovery of oil. Today, KIA manages the Kuwait General Reserve Fund, the Kuwait Future Generations Fund, as well as any other moneys committed by the Ministry of Finance. The Kuwait Future Generations Fund has 10% of annual oil revenues added to it. Currently this fund is worth over $3 trillion.