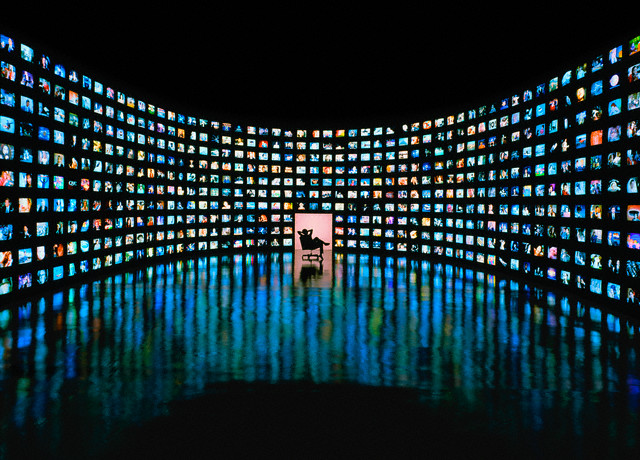

Nothing symbolises the success of Capitalism more than its mass media. The media today has arguably penetrated every household in the world, in one form or another. Journalists across the Western world pride themselves in reporting objectively on global events and regard an independent media as one of the pillars of a democratic society which accounts the state.

Nothing symbolises the success of Capitalism more than its mass media. The media today has arguably penetrated every household in the world, in one form or another. Journalists across the Western world pride themselves in reporting objectively on global events and regard an independent media as one of the pillars of a democratic society which accounts the state.

The Western world has argued for decades that a critical aspect of a functioning democracy and a developed nation is for society to be well-informed in order to participate effectively in that democracy. One of the most important ways that many people are informed of affairs, whether global, national or local, is through their respective mainstream media. In a world of increasing globalisation, the media has become even more important. It has the possibility of spreading information to places where in the past it has been difficult to project diverse views in.

Most people gather their view of the world from the media. It is, therefore, important that mainstream media be objective and present accurate and diverse representations of what happens around the world. However, over the last few decades, we have seen various factions across the world with self-interests that have been able to successfully manipulate the media for their advantage. This is a phenomenon encapsulated by former owner of The Washington Post, Kathrine Graham, in a speech to the CIA, “We live in a dirty and dangerous world. There are some things the general public does not need to know about and shouldn’t. I believe democracy flourishes when the government can take legitimate steps to keep its secrets and when the press can decide whether to print what it knows.”[1]

Reality of the Global Media

When one speaks of the general media coverage of issues related to Islam and the Muslims, it is quite common to stumble across phrases such as, “The Jews control the media” or, “The Freemasons control the media.” Whilst it is true that there are many supporters of Zionism in the media world (for example, Professor Bernard Lewis, a renowned Orientalist, Judith Miller and Serge Schmemann (New York Times) and Joel Greenberg (The Chicago Tribune)), it is a vast over-simplification to assert that the Jews control it.

A closer examination of the global media illustrates that it is not one homogenous entity pursuing a uniform method in disseminating their views. On the contrary, there are a small number of large factions which compete with one another to increase their respective audiences and commercial gains. Since the 1980’s, there have been numerous mergers and buyouts of media and entertainment companies. The global media has since become more concentrated in terms of ownership and, with this, the influences of advertisers and owning companies both have a powerful clout on how the media shapes itself and society.

In 2007, there were only eight mega media companies dominating American media. It is from these that the majority of people received news and information. US media giants are also global players:

* Disney

* AOL-Time Warner

* Viacom

* General Electric

* News Corporation

* Yahoo!

* Microsoft

* Google

Yahoo!, Microsoft, and Google are more recent media companies compared to the other “traditional” five players. Most of these companies are in the global elite of media companies too. In 2007, nine corporations (mainly American) dominated the media world:

* AOL-Time Warner

* Disney

* Bertelsmann

* Viacom

* News Corporation

* TCI

* General Electric (owner of NBC)

* Sony (owner of Columbia and TriStar Pictures and major recording interests), and

* Seagram (owner of Universal film and music interests).

This monopoly over the world’s media was aptly summed up in a review of the changes that took place in the media industry over the last decade.

“In 1983, fifty corporations dominated most of every mass medium and the biggest media merger in history was a $340 million deal. … [I]n 1987, the fifty companies had shrunk to twenty-nine. … [I]n 1990, the twenty-nine had shrunk to twenty three. … [I]n 1997, the biggest firms numbered ten and involved the $19 billion Disney-ABC deal, at the time the biggest media merger ever. … [In 2000] AOL Time Warner’s $350 billion merged corporation [was] more than 1,000 times larger [than the biggest deal of 1983].”[2]

The global media is dominated by a small number of powerful, mostly US-based, trans-national media corporations. This concentration of ownership has led to a system that works to advance the cause of the global free market and to promote commercial values. Such a system is a relatively recent development. Until the 1980’s media systems were generally national in scope. Whilst there has always been the import of books, films, music and TV shows for decades, the basic broadcasting systems and newspaper industries were domestically owned and regulated. Beginning in the 1980’s, pressure from the IMF, World Bank and US Government to deregulate and privatise media and communication systems coincided with new satellite and digital technologies, resulting in the rise of trans-national media giants.

The two largest media firms in the world, Time Warner and Disney, generated around 15% of their income outside of the US in 1990. By 1997, this figure was increased, nearing the 30% – 35% mark. Both firms expect to conduct the majority of their businesses abroad within the next decade.

The global media system is now dominated by a first tier of nine giant firms. The five largest are:

* Time Warner

* Disney

* Bertelsmann

* Viacom

* News Corporation

Besides needing global scope to compete, the rules of thumb for global media giants are two-fold.

Firstly, expanding and becoming larger so that they dominate markets and render competitors incapable of buying them out. As an example, firms such as Disney and Time Warner have almost tripled in size this decade.

Secondly, to spread their firms interests in numerous media industries such as film production, book publishing, music, TV channels and networks, retail stores, amusement parks, magazines, newspapers etc. The overall profit for the global media giant can be vastly greater than the sum of its media-parts. A film, for example, would also generate a soundtrack, a book, and merchandise, and possibly spin-off TV shows, DVDs, video games and amusement park rides. Firms that do not have conglomerated media holdings simply cannot compete in this market.

The first tier in the list above is rounded out by TCI, the largest US cable-company that also has US and global media holdings in scores of ventures. The other three, first-tier global media firms are all part of much larger, industrial corporate powerhouses such as General Electric, owner of NBC; Sony, owner of Columbia & TriStar Pictures and major recording interests; and Seagram, owner of Universal Film and music interests. The media holdings of these last four firms conduct between $6-9 billion in business every year. While they are not as diverse as the media holdings of the first five global media giants, these four firms have global distribution and production in areas where they compete. In addition to this, firms such as Sony and General Electric have the resources to make deals to rapidly expand if they so desire.

Behind these firms is a second tier of some three or four dozen media firms that conduct between $1-8 billion per year in media-related businesses. These firms tend to have national or regional strongholds or to specialize in global niche markets. Approximately half of them originate from North America, including the likes of CBS, The New York Times Co., Hearst, Comcast and Gannett. The majority of the remainder originate from Europe, with but a handful based in East-Asia and Latin America.

The Independent and Liberal Media Myth

The overwhelming majority of the world’s film production, TV show production, cable channel ownership, cable and satellite system ownership, book publishing, magazine publishing, newspapers and music production are provided by fifty or so firms – the first nine firms of which thoroughly dominate many of these sectors. By any standard, such a concentration of media power makes this industry extremely powerful.

On the international scene, the most significant players are Rupert Murdoch and Ted Turner and, until recently, Conrad Black, owner of Hollinger International.

Rupert Murdoch owns the US-based News Corporation, which owns News International in the UK. The News Corporation is one of the largest media organisations in existence today, exerting tremendous influence upon governments across the world due to its immense financial and publicity capability. The News Corporation also owns Fox News, the Sun, the UK-based Times, The News of the World and British Sky Broadcasting (which also owns 26 satellite channels, most known amongst them including Sky News). It also claims a staggering 37% of daily sales and 39% of the Sunday share of all newspaper sales.

The sheer amount of money and publicity such corporations and individuals yield makes it very important for governments across the world to keep such companies and individuals in their favour. The Labour party in the UK maintains a close relationship with Rupert Murdoch. As one labour MP once said, “The motivation is clear: It is to keep Mr. Murdoch on-board and keep his newspapers on side. It seems the Prime Minister is very much in bed with Mr Murdoch.”[3] This certainly highlights the close relationship between the media and politicians.

All this demonstrates that the media is primarily owned by only a handful of Capitalist firms. Profit-maximisation is the primary objective, which is achieved through the Capitalist ideological framework.

A whole host of factors converge on the global media industry which filters out all views and opinions that may affect the bottom line of all those involved in this industry. Media companies are profit-seeking businesses owned by wealthy individuals or other companies. Such companies, to a large extent, are funded by advertisers who are also profit-seeking businesses and who want their advertisements to appear in a supporting environment. The media is dependent upon Government and major business as information sources. Political considerations and overlapping interests cause a degree of solidarity to prevail among the government, media and other corporate interests. Governments and large multinationals are best positioned and wealthy to be able to pressure the media with threats of withdrawal of advertising or TV licensing and libel suits.

The Capitalist media conglomerates have their commercial interests which are achieved by increasing the size of their audiences. One of the ways this is achieved is by targeting particular audiences. For example, The Sun, the UK’s most-regularly read tabloid, adopts sensationalist, alarmist, and often cheap yet attention grabbing headlines as this is what appeals to much of the British audience. In the US, during the Iraq War, news broadcasters devoted only 38 seconds to US foreign policy, whilst over 6 minutes out of a 30 minute newscast was given to the weather. US media outlets were worried of the effect grisly images from war would have on advertisers.[4] Despite the varying persuasions on the political spectrum between different editors and publishers, they all broadly share the secular worldview. Whilst it is an undoubted fact that the Western media in general is antagonistic towards Islam and Muslims, it would however be somewhat inappropriate to paint all media outlets with the same brush such as ‘They are all Muslim haters’ and ‘controlled by the Jews’. However, the secular outlook is a reality and one needs to examine the roots of this hostility.

The Global Media and Islam

It is crucial to comprehend the basis of the Western media and the roots of its hostile coverage of Islam. This is best understood by examining the Western media coverage of the Communist Bloc up until its collapse in 1989. From the moment the Cold War began, the media as well as the Western governments were markedly aggressive towards the Communist Bloc. This is exemplified by the American hysteria through McCarthyism in the early 1950’s and it’s obsession vis-a-vis Vietnam and Cuba in the early 1960’s. The source of this hostility was ideological, a battle of worldviews between Communism and Capitalism. However, with the demise of Communism, Islam has re-emerged as the ideological adversary of the West. ‘The Red Menace is Gone. But Here’s Islam. the Green Menace,’ was the title of an article by Elaine Sciolino on 21 January 1996, in the New York Times.

The leading American political scientist, Samuel Huntington, argued that the Cold War was merely a ‘fleeting and superficial’ historical phenomenon, compared to the centuries old clash between the West and the Islamic civilisation. The source of this hostility is the basis of Capitalism, which is the separation of the Church and State (religion and politics), the base idea of secularism. This basis, in essence, not only rejects the idea of ruling according to divine guidance, but it also staunchly struggles against any attempts to do so. Thus, secularism insists upon the restriction of religion to the private realm. Islam, in contrast, is the opposite of this. Hence Islam commands that the Shari’ah be implemented not only in one’s private life but also in society. As Francis Fukuyama argued, “Islam constitutes a systematic and coherent ideology, like Liberalism and Communism, with it’s own code of morality and doctrine of political and social justice.” Consequently, Huntington concluded, “So long as Islam remains Islam (which it will) and the West remains the West (which is more dubious), this fundamental conflict between two civilisations and ways of life will continue to define their relations in the future…”[5]

The source of the negative media portrayal of Islam is ideological, as the principles of Islam fundamentally clash with those of Capitalism. In light of this fact, certain journalists are hostile towards Islam whilst many others merely follow the current trends and may even be opportunists, hence their journalism is characterized by ignorance and confusion. We should certainly not be surprised by such loathing media coverage. Cases of media bias are innumerable; for example the Western media gave ample coverage to the colour revolutions that took place in Central Asia, however at the same time gave very little coverage of certain events, which, if highlighted, would affect Western interests. The massacres in Andijan attracted very little exposure, partly because America and Britain have strategic and commercial interests in Uzbekistan. Thus, the lack of reporting or over-reporting is part of the media’s manipulation of events.

Zionism

Israel’s invasion of Gaza in January 2009 was also littered with biased media coverage where the rockets fired by Hamas were shown in a light different to the massacre that was taking place in Gaza by the Israeli Army. Many across the Western world share a sentimental attachment with Israel, particularly many liberals from the post-war generation in leadership positions in government and the media. Many identify with Israel’s historical struggle, internal democracy, relatively high standard of living and its role as a sanctuary for an oppressed minority group that spent centuries in diaspora.

The Christian Right in the US, with tens of millions of followers and a major base of support for the Republican Party, historically has thrown its immense media and political clout in support of Israel and other right-wing Israeli leaders. As a result, it is such realities that have shaped the opinions of journalists when reporting on Israel and any conflict in the region. This is why Israel is usually shown in a favourable light.

The Israeli government has found many friends within the media industry and many Israelis have been able to reach influential positions within the global media due to the history of the Israeli nation. However it is the corporations that have the most powerful influence in the global media industry and, with the favourable opinion across the Western world for the struggle the Jews have had to bare, it would not make financial sense for any media corporation to have an anti-Israeli stance.

This shows that without a state, it is virtually impossible to mould global opinion. Israel has shown a small population backed by a state can achieve significant results. On the other hand, Western media magnates and their outlets are supported by states. Rupert Murdoch and Ted Turner have powerful secular states behind them. The BBC, Sky and CNN are backed by Capitalist states to provide media coverage in their ideological framework. The Islamic media, on the other hand, has no such state support.

Conclusion

It should be clear to us that the source of hostility from the Western media towards Islam is ideological. The media is neither controlled by the Jews nor by Christians per se, rather it’s part of the secular, liberal Capitalist world order. This Western order advances its material interests and secular ideological views globally. Any obstacles in its path, which is primarily from Islam and Muslims today, is demonised and dehumanised. Many think-tanks across the Western world can clearly identify that, whereas most other cultural groupings appear to have accepted America’s global role, it is only from the Islamic world that signs of determined resistance emerge still strong. Therefore we have attacks on Islam from individuals and this is the source of the perpetual negative media portrayal of Islam and Muslims. Muslims globally need to acquaint themselves with Islam and those from the Ummah residing in the West should take up the challenge to present the true picture of Islam. They should, if possible, work to have their own media outlets so Muslims from different backgrounds and skills can come together in a united manner to defend Islam.

It should be remembered that a strong media is only developed when a people with an ideology have a state. The Khilafah is the overall solution to the lies perpetuated by the Capitalist-dominated media.

The following corporate profiles are based on The Global Media: The New Missionaries of Corporate Capitalism (Cassell, 1997), co-authored with Edward S. Herman.

Time Warner

$25 billion – 1997 sales

Time Warner, the largest media corporation in the world, was formed in 1989 through the merger of Time Inc. and Warner Communications. In 1992, Time Warner split off its entertainment group, and sold 25 percent of it to U.S. West, and 5.6 percent of it to each of the Japanese conglomerates Itochu and Toshiba. It regained from Disney its position as the world’s largest media firm with the 1996 acquisition of Turner Broadcasting.

Time Warner is moving toward being a fully global company, with over 200 subsidiaries worldwide. In 1996, approximately two-thirds of Time Warner’s income came from the United States, but that figure is expected to drop to three-fifths by 2000 and eventually to less than one-half. Time Warner expects globalization to provide growth tonic; it projects that its annual sales growth rate of 14 percent in the middle 1990s will climb to over 20 percent by the end of the decade.

Music accounts for just over 20 percent of Time Warner’s business, as does the news division of magazine and book publishing and cable television news. Time Warner’s U.S. cable systems account for over 10 percent of income. The remainder is accounted for largely by Time Warner’s extensive entertainment film, video and television holdings. Time Warner is a major force in virtually every medium and on every continent.

Time Warner has zeroed in on global television as the most lucrative area for growth. Unlike News Corporation, however, Time Warner has devoted itself to producing programming and channels rather than developing entire satellite systems. Time Warner is also one of the largest movie theater owners in the world, with approximately 1,000 screens outside of the United States and further expansion projected.

The Time Warner strategy is to merge the former Turner global channels–CNN and TNT/Cartoon Channel–with their HBO International and recently launched Warner channels to make a four-pronged assault on the global market. HBO International has already established itself as the leading subscription TV channel in the world; it has a family of pay channels and is available in over 35 countries. HBO President Jeffrey Bewkes states that global expansion is HBO’s “manifest destiny.”

CNN International, a subsidiary of CNN, is also established as the premier global television news channel, beamed via ten satellites to over 200 nations and 90 million subscribers by 1994, a 27 percent increase over 1993. The long-term goal for CNN International is to operate (or participate in joint ventures to establish) CNN channels in French, Japanese, Hindi, Arabic and perhaps one or two other regional languages. CNN launched a Spanish-language service for Latin America in 1997, based in Atlanta. CNN International will also draw on the Time Warner journalism resources as it faces new challenges from news channels launched by News Corporation and NBC-Microsoft.

Before their 1996 merger, Turner and Time Warner were both global television powers with the TNT/Cartoon Network and Warner channels, drawing upon their respective large libraries of cartoons and motion pictures. Now these channels will be redeployed to better utilize each other’s resources, with plans being drawn up to develop several more global cable channels to take advantage of the world’s largest film, television and cartoon libraries.

Time Warner selected holdings

-

Majority interest in WB, a U.S. television network launched in 1995 to provide a distribution platform for Time Warner films and programs. It is carried on the Tribune Company’s 16 U.S. television stations, which reach 25 percent of U.S. TV households;

-

Significant interests in non-U.S. broadcasting joint ventures;

-

The largest cable system in the United States, controlling 22 of the largest 100 markets;

-

Several U.S. and global cable television channels, including CNN, Headline News, CNNfn, TBS, TNT, Turner Classic Movies, The Cartoon Network and CNN-SI (a cross-production with Sports Illustrated);

-

Partial ownership of the cable channel Comedy Central and a controlling stake in Court TV;

-

HBO and Cinemax pay cable channels;

-

Minority stake in PrimeStar, U.S. satellite television service;

-

Warner Brothers and New Line Cinema film studios;

-

More than 1,000 movie screens outside of the United States;

-

A library of over 6,000 films, 25,000 television programs, books, music and thousands of cartoons;

-

Twenty-four magazines, including Time, People and Sports Illustrated;

-

Fifty percent of DC Comics, publisher of Superman, Batman and 60 other titles;

-

The second largest book-publishing business in the world, including Time-Life Books (42 percent of sales outside of the United States) and the Book-of-the-Month Club;

-

Warner Music Group, one of the largest global music businesses with nearly 60 percent of revenues from outside the United States;

-

Six Flags theme park chain; The Atlanta Hawks and Atlanta Braves professional sports teams; Retail stores, including over 150 Warner Bros. stores and Turner Retail Group; Minority interests in toy companies Atari and Hasbro.

Disney

$24 billion – 1997 sales

Disney is the closest challenger to Time Warner for the status of world’s largest media firm. In the early 1990s, Disney successfully shifted its emphasis from its theme parks and resorts to its film and television divisions. In 1995, Disney made the move from being a dominant global content producer to being a fully integrated media giant with the purchase of Capital Cities/ABC for $19 billion, one of the biggest acquisitions in business history.

Disney now generates 31 percent of its income from broadcasting, 23 percent from theme parks, and the balance from “creative content,” meaning films, publishing and merchandising. The ABC deal provided Disney, already regarded as the industry leader at using cross-selling and cross-promotion to maximize revenues, with a U.S. broadcasting network and widespread global media holdings to incorporate into its activities.

Consequently, according to Advertising Age (8/7/95), Disney “is uniquely positioned to fulfill virtually any marketing option, on any scale, almost anywhere in the world.” It has already included the new Capital Cities/ABC brands in its exclusive global marketing deals with McDonald’s and Mattel toymakers. Although Disney has traditionally preferred to operate on its own, C.E.O. Michael Eisner has announced Disney’s plans to expand aggressively overseas through joint ventures with local firms or other global players, or through further acquisitions. Disney’s stated goal is to expand its non-U.S. share of revenues from 23 percent in 1995 to 50 percent by 2000.

Historically, Disney has been strong in entertainment and animation, two areas that do well in the global market. In 1996 Disney reorganized, putting all its global television activities into a single division, Disney/ABC International Television. Its first order of business is to expand the children- and family-oriented Disney Channel into a global force, capitalizing upon the enormous Disney resources. Disney is also developing an advertising-supported children’s channel to complement the subscription Disney Channel.

For the most part, Disney’s success has been restricted to English-language channels in North America, Britain and Australia. Disney’s absence has permitted the children’s channels of News Corporation, Time Warner and especially Viacom to dominate the lucrative global market. Disney launched a Chinese-language Disney Channel based in Taiwan in 1995, and plans to launch Disney Channels in France, Italy, Germany and the Middle East. “The Disney Channel should be the killer children’s service throughout the world,” Disney’s executive in charge of international television states.

With the purchase of ABC’s ESPN, the television sports network, Disney has possession of the unquestioned global leader. ESPN has three U.S. cable channels, a radio network with 420 affiliates, and the ESPN Sports-Zone website, one of the most heavily used locales on the Internet. One Disney executive notes that with ESPN and the family-oriented Disney Channel, Disney has “two horses to ride in foreign markets, not just one.”

ESPN International dominates televised sport, broadcasting on a 24-hour basis in 21 languages to over 165 countries. It reaches the one desirable audience that had eluded Disney in the past: young, single, middle-class men. “Our plan is to think globally but to customize locally,” states the senior VP of ESPN International. In Latin America the emphasis is on soccer, in Asia it is table tennis, and in India ESPN provided over 1,000 hours of cricket in 1995.

Disney plans to exploit the “synergies” of ESPN much as it has exploited its cartoon characters. “We know that when we lay Mickey Mouse or Goofy on top of products, we get pretty creative stuff,” Eisner states. “ESPN has the potential to be that kind of brand.” Disney plans call for a chain of ESPN theme sports bars, ESPN product merchandising, and possibly a chain of ESPN entertainment centers based on the Club ESPN at Walt Disney World. ESPN has released five music CDs, two of which have sold over 500,000 copies. In late 1996, Disney began negotiations with Hearst and Petersen Publishing to produce ESPNSports Weekly magazine, to be a “branded competitor to Sports Illustrated.”

Disney selected holdings

-

The U.S. ABC television and radio networks;

-

Ten U.S. television stations and 21 U.S. radio stations;

-

U.S. and global cable television channels Disney Channel, ESPN, ESPN2 and ESPNews; holdings in Lifetime, A & E and History channels;

-

Americast, interactive TV joint venture with several telephone companies;

-

Several major film, video and television production studios including Disney, Miramax and Buena Vista;

-

Magazine and newspaper publishing, through its subsidiaries, Fairchild Publications and Chilton Publications;

-

Book publishing, including Hyperion Books and Chilton Publications;

-

Several music labels, including Hollywood Records, Mammoth Records and Walt Disney Records;

-

Theme parks and resorts, including Disneyland, Disney World and stakes in major theme parks in France and Japan;

-

Disney Cruise Line;

-

DisneyQuest, a chain of high-tech arcade game stores;

-

Controlling interests in the NHL Anaheim Mighty Ducks and major league baseball’s Anaheim Angels;

-

Consumer products, including more than 550 Disney retail stores worldwide.

Bertelsmann

$15 billion – 1996 sales

Bertelsmann is the one European firm in the first tier of media

giants. The Bertelsmann empire was built on global networks of book and

music clubs. Music and television provide 31 percent of its income, book

publishing 33 percent, magazines and newspapers 20 percent, and a global

printing business accounts for the remainder. In 1994 its income was

distributed among Germany (36 percent), the rest of Europe (32 percent),

the United States (24 percent) and the rest of the world (8 percent).

Bertelsmann’s stated goal is to evolve “from a media enterprise with

international activities into a truly global communications group.”

Bertelsmann’s strengths in global expansion are its global distribution

network for music, its global book and music clubs, and its facility

with languages other than English. It is working to strengthen its music

holdings to become the world leader, through a possible buyout of–or

merger with–EMI and through establishing joint ventures with local

music companies in emerging markets. Bertelsmann is considered to be the

best contender of all the media giants to exploit the Eastern European

markets.

Bertelsmann has two severe competitive disadvantages in the global

media sweepstakes. It has no significant film or television production

studios or film library, and it has minimal involvement in global

television, where much of the growth is taking place. The company began

to address this problem in 1996 by merging its television interests

(Ufa) into a joint venture with Compagnie Luxembourgeoise de

Telediffusion (CLT), the Luxembourg-based European commercial

broadcasting power. According to a Bertelsmann executive, the CLT deal

was “a strategic step to become a major media player, especially in

light of the recent European and American mergers.”

Bertelsmann selected holdings

-

German television channels RTL, RTL2, SuperRTL

and Vox; -

Part ownership of Premiere, Germany’s largest pay-TV channel;

-

Stakes in British, French and Dutch TV channels;

-

50 percent stake in CLT-Ufa, which owns 19 European TV channels and

23 European radio stations; -

Eighteen European radio stations;

-

Newspaper and magazine publishing, including more than 100

magazines; -

Book publishing, with some 40 publishing houses, concentrating on

German-, French- and English-language (Bantam and Doubleday Dell)

titles; -

Major recording studios Arista and RCA;

-

Leading book and record clubs in the world.

Viacom

$13 billion – 1997 sales

C.E.O. Sumner Redstone, who controls 39 percent of Viacom’s

stock, orchestrated the deals that led to the acquisitions of Paramount

and Blockbuster in 1994, thereby promoting the firm from $2 billion in

1993 sales to the front ranks. Viacom generates 33 percent of its income

from its film studios, 33 percent from its music, video rentals and

theme parks, 18 percent from broadcasting, and 14 percent from

publishing. Redstone’s strategy is for Viacom to become the world’s

“premier software driven growth company.”

Viacom’s growth strategy is twofold. First, it is implementing an

aggressive policy of using company-wide cross-promotions to improve

sales. It proved invaluable that MTV constantly plugged the film

Clueless in 1995, and the same strategy will be applied to the

Paramount television program based on the movie. Simon & Schuster is

establishing a Nickelodeon book imprint and a “Beavis and Butthead” book

series based on the MTV characters. Viacom also has plans to

establish a comic-book imprint based upon Paramount characters, it is

considering creating a record label to exploit its MTV brand name

and it has plans to open a chain of retail stores to capitalize upon its

“brands” ^ la Disney and Time Warner. In 1997 Paramount will begin

producing three Nickelodeon and three MTV movies annually. “We’re just

now beginning to realize the benefits of the Paramount and Blockbuster

mergers,” Redstone stated in 1996.

Second, Viacom has targeted global growth, with a stated goal of

earning 40 percent of its revenues outside of the United States by 2000.

As one Wall Street analyst puts it, Redstone wants Viacom “playing in

the same international league” with News Corporation and Time Warner.

Since 1992 Viacom has invested between $750 million and $1 billion in

international expansion. “We’re not taking our foot off the

accelerator,” one Viacom executive states.

Viacom’s two main weapons are Nickelodeon and MTV.

Nickelodeon has been a global powerhouse, expanding to every

continent but Antarctica in 1996 and 1997 and offering programming in

several languages. It is already a world leader in children’s

television, reaching 90 million TV households in 70 countries other than

the United States–where it can be seen in 68 million households and

completely dominates children’s television.

MTV is the preeminent global music television channel,

available in 250 million homes worldwide and in scores of nations. In

1996 Viacom announced further plans to “significantly expand” its global

operations. MTV has used new digital technologies to make it

possible to customize programming inexpensively for different regions

and nations around the world.

Viacom selected holdings

-

Thirteen U.S. television stations;

-

A 50 percent interest in the U.S. UPN television network with

Chris-Craft Industries; -

U.S. and global cable television networks, including MTV,

M2, VH1, Nickelodeon, Showtime,

TVLand and Paramount Networks; -

A 50 percent interest in Comedy Central channel (with Time

Warner); -

Film, video and television production, including Paramount Pictures;

-

50 percent stake in United Cinemas International, one of the world’s

three largest theater companies; -

Blockbuster Video and Music stores, the world’s largest video rental

stores; -

Book publishing, including Simon & Schuster, Scribners and

Macmillan; -

Five theme parks.

News Corporation

$10 billion – 1996 sales

The News Corporation is often identified with its head, Rupert

Murdoch, whose family controls some 30 percent of its stock. Murdoch’s

goal is for News Corporation to own multiple forms of programming–news,

sports, films and children’s shows–and beam them via satellite or TV

stations to homes in the United States, Europe, Asia and South America.

Viacom CEO Sumner Redstone says of Murdoch that “he basically wants to

conquer the world.”

And he seems to be doing it. Redstone, Disney CEO Michael Eisner, and

Time Warner CEO Gerald Levin have each commented that Murdoch is the one

media executive they most respect and fear, and the one whose moves they

study. TCI’s John Malone states that global media vertical integration

is all about trying to catch Rupert. Time Warner executive Ted Turner

views Murdoch in a more sinister fashion, having likened him to Adolf

Hitler.

After establishing News Corporation in his native Australia, Murdoch

entered the British market in the 1960s and by the 1980s had become a

dominant force in the U.S. market. News Corporation went heavily into

debt to subsidize its purchase of Twentieth Century Fox and the

formation of the Fox television network in the 1980s; by the

mid-1990s News Corporation had eliminated much of that debt.

News Corporation operates in nine different media on six continents.

Its 1995 revenues were distributed relatively evenly among filmed

entertainment (26 percent), newspapers (24 percent), television (21

percent), magazines (14 percent) and book publishing (12 percent). News

Corporation has been masterful in utilizing its various properties for

cross-promotional purposes, and at using its media power to curry

influence with public officials worldwide. “Murdoch seems to have

Washington in his back pocket,” observed one industry analyst after News

Corporation received another favorable ruling (New York Times,

7/26/96). The only media sector in which News Corporation lacks a major

presence is music, but it has a half-interest in the Channel V

music television channel in Asia.

Although News Corporation earned 70 percent of its 1995 income in the

United States, its plan for global expansion looks to continental

Europe, Asia and Latin America, areas where growth is expected to be

greatest for commercial media. Until around 2005, Murdoch expects the

surest profits in the developed world, especially Europe and Japan. News

Corporation is putting most of its eggs in the basket of television,

specifically digital satellite television. It plans to draw on its

experience in establishing the most profitable satellite television

system in the world, the booming British Sky Broadcasting

(BSkyB). News Corporation can also use its U.S. Fox

television network to provide programming for its nascent satellite

ventures. News Corporation is spending billions of dollars to establish

these systems around the world; although the risk is considerable, if

only a few of them establish monopoly or duopoly positions the entire

project should prove lucrative.

News Corporation selected holdings

-

The U.S. Fox broadcasting network;

-

Twenty-two U.S. television stations, the largest U.S. station group,

covering over 40 percent of U.S. TV households; -

Fox News Channel;

-

A 50 percent stake (with TCI’s Liberty Media) in several U.S. and

global cable networks, including fx, fxM and Fox Sports

Net; -

50 percent stake in Fox Kids Worldwide, production studio and owner

of U.S. cable Family Channel; -

Ownership or major interests in satellite services reaching Europe,

U.S., Asia, and Latin America, often under the Sky Broadcasting brand; -

Twentieth Century Fox, a major film, television and video production

center, which has a library of over 2,000 films to exploit; -

Some 132 newspapers (primarily in Australia, Britain and the United

States, including the London Times and the New York Post),

making it one of the three largest newspaper groups in the world; -

Twenty-five magazines, most notably TV Guide;

-

Book publishing interests, including HarperCollins;

-

Los Angeles Dodgers baseball team.

Sony

$9 billion – 1997 sales (media only)

Sony’s media holdings are concentrated in music (the former CBS

records) and film and television production (the former Columbia

Pictures), each of which it purchased in 1989. Music accounts for about

60 percent of Sony’s media income and film and television production

account for the rest. Sony is a dominant entertainment producer, and its

media sales are expected to surpass $9 billion in 1997. It also has

major holdings in movie theaters in joint venture with Seagram. As

Sony’s media activities seem divorced from its other extensive

activities–Sony expects $50 billion in company-wide sales in

1997–there is ongoing speculation that it will sell its valuable

production studios to vertically integrated chains that can better

exploit them.

Sony was foiled in its initial attempts to find synergies between

hardware and software, but it anticipates that digital communication

will provide the basis for new synergies. Sony hopes to capitalize upon

its vast copyrighted library of films, music and TV programs to leap to

the front of the digital video disc market, where it is poised to be one

of the two global leaders with Matsushita. Sony also enjoys a 25 percent

share of the multi-billion-dollar video games industry; with the shift

to digital formats these games can now be converted into channels in

digital television systems.

TCI

$7 billion – 1996 sales

TCI (Tele-Communications Inc.) is smaller than the other firms in

the first tier, but its unique position in the media industry has made

it a central player in the global media system. TCI’s foundation is its

dominant position as the second biggest U.S. cable television system

provider. C.E.O. John Malone, who has effective controlling interest

over TCI, has been able to use the steady cash influx from the lucrative

semi-monopolistic cable business to build an empire.

Malone understands the importance of the U.S. cable base to bankroll

TCI’s expansion; in 1995 and 1996 he bought several smaller cable

systems to consolidate TCI’s hold on the U.S. cable market. TCI faces a

direct and potentially very damaging challenge to its U.S. market share

from digital satellite broadcasting. It is responding by converting its

cable systems to digital format so as to increase channel capacity to

200. TCI is also using its satellite spin-off to position itself in the

rival satellite business and retain some of the 15 to 20 million

Americans expected to switch from cable broadcasting to satellite

broadcasting by 2000. In addition to owning two satellites valued at

$600 million, TCI holds a 21 percent stake in Primestar, a U.S.

satellite television joint venture with the other leading U.S. cable

companies, News Corporation and General Electric, which already had 1.2

million subscribers in l996.

TCI has used its control of cable systems to acquire equity stakes in

many of the cable channels that need to be carried over TCI to be

viable. TCI has significant interests in Discovery, QVC,

Fox Sports Net, Court TV, E!, Home Shopping

Network and Black Entertainment TV, among others. In 1996,

TCI negotiated the right to purchase a 20 percent stake in News

Corporation’s new Fox News Channel in return for access to TCI

systems. Through its subsidiary Liberty Media, TCI has interests in 91

U.S. program services.

Nor does TCI restrict its investments to cable channels and content

producers. It has a 10 percent stake in Time Warner as well as a 20

percent stake in Silver King Communications, where former Fox

network builder Barry Diller is putting together another U.S. television

network.

TCI has applied its expansionist strategy to the global as well as

domestic media market. On the one hand, TCI develops its core cable

business and has become the global leader in cable systems, with strong

units in Britain, Japan and Chile. Merrill Lynch estimates that TCI

International’s cable base outside of the United States will increase

from 3 million subscribers in 1995 to 10 million in 1999.

On the other hand, TCI uses its cable resources to invest across all

global media and to engage in numerous non-cable joint ventures. “When

you are the largest cable operator in the world,” a TCI executive

states, “people find a way to do business with you.” It already has 30

media deals outside of the United States, including a venture with Sega

Enterprises to launch computer game channels, a joint venture with News

Corporation for a global sports channel, and a 10 percent stake in Sky

Latin America.

Universal (Seagram)

$7 billion – 1997 sales

Effectively controlled by the Bronfman family, the global

beverage firm Seagram purchased Universal (then MCA) from Matsushita for

$5.7 billion in 1995. Matsushita was unable to make a success of MCA and

had refused to go along with MCA executives who had wanted to acquire

CBS in the early l990s. Universal is expected to account for

approximately half of Seagram’s $14 billion in sales in 1997.

Over half of Universal’s income is generated by the Universal

Studios’ production of films and television programs. Universal is also

a major music producer and book publisher and operates several theme

parks. As many of the broadcast networks and cable channels vertically

integrate with production companies, Universal has fewer options for

sales and is less secure in its future. It owns the cable USA

Network and the Sci-Fi Network, after buying out its uneasy

partner Viacom.

NBC (GE)

$5 billion – 1996 sales

General Electric is one of the leading electronics and

manufacturing firms in the world with nearly $80 billion in sales in

1996. Its operations have become increasingly global, with non-U.S.

revenues increasing from 20 percent of the total in 1985 to 38 percent

in 1995, and an expected 50 percent in 2000. Although NBC currently

constitutes only a small portion of GE’s total activity, after years of

rapid growth it is considered to be the core of GE’s strategy for

long-term global growth.

NBC owns U.S. television and radio networks and 11 television

stations. It has been aggressive in expanding into cable, where it now

owns several cable channels outright, like CNBC, as well as

shares in some 20 other channels, including the A&E network.

The most dramatic expression of GE’s media-centered strategy is its 1996

alliance and joint investment with Microsoft to produce the cable news

channel MSNBC, along with a complementary on-line service. From

this initial $500 million investment, NBC and Microsoft plan to expand

MSNBC quickly into a global news channel, followed perhaps by a

global entertainment and sports channel. NBC and Microsoft are also

developing a series of TV channels in Europe aimed at computer users.

The Second Tier

Below the global giants in the media food chain is a second tier of corporations that fill regional or niche markets. Some of these firms are as large as the smaller global companies, but lack their world-wide reach. A few second-tier companies may attempt, through aggressive mergers and acquisitions of like-sized firms, to become full-blown first-tier global media giants; others will likely be swallowed by larger companies amassing ever greater empires.

U.S.

-

Westinghouse $5 billion

-

Advance Publications $4.9 billion

-

Gannett $4.0 billion

-

Cox Enterprises $3.8 billion

-

Times-Mirror $3.5 billion

-

Comcast $3.4 billion

-

McGraw Hill $3 billion

-

Reader’s Digest $3 billion

-

Knight-Ridder $2.9 billion

-

Dow Jones $2.5 billion

-

New York Times Co. $2.5 billion

-

Tribune Co. $2.2 billion

-

Hearst $2 billion

-

Washington Post Co. $1.8 billion

-

Cablevision $1.1 billion

-

DirecTV (Owned by General Motors)

-

DreamWorks

Canada

-

Thomson $7.3 billion

-

Rogers Communications $2 billion

-

Hollinger

Latin America

-

Cisneros Group (Venezuela) $3.2 billion

-

Globo (Brazil) $2.2 billion

-

Clarin (Argentina) $1.2 billion

-

Televisa (Mexico) $1.2 billion

Europe

-

Havas (France) $8.8 billion

-

Reed Elsevier (Britain/Netherlands) $5.5 billion

-

EMI (Britain) $5.4 billion

-

Hachette (France) $5.3 billion

-

Reuters (Britain) $4.1 billion

-

Kirch Group (Germany) $4 billion

-

Granada Group (Britain) $3.6 billion

-

BBC (Britain) $3.5 billion

-

Axel Springer (Germany) $3 billion

-

Canal Plus (France) $3 billion

-

CLT (Luxembourg) $3 billion

-

Pearson PLC (Britain) $2.9 billion

-

United News & Media (Britain) $2.9 billion

-

Carlton Communications (Britain) $2.5 billion

-

Mediaset (Italy) $2 billion

-

Kinnevik (Sweden) $1.8 billion

-

Television Francais 1 (France) $1.8 billion

-

Verlagsgruppe Bauer (Germany) $1.7 billion

-

Wolters Kluwer (Netherlands) $1.7 billion

-

RCS Editori Spa (Italy) $1.6 billion

-

VNU (Netherlands) $1.4 billion

-

Prisa Group (Spain)

-

Antena 3 (Spain)

-

CEP Communications (France)

Asia/Pacific

-

NHK (Japan) $5.6 billion

-

Fuji Television (Japan) $2.6 billion

-

Nippon Television Network (Japan) $2.2 billion

-

Cheil Jedang (Korea) $2.1 billion

-

Tokyo Broadcasting System (Japan) $2.1 billion

-

Modi (India) $2 billion

-

Asahi National Broadcasting Co. (Japan) $1.6 billion

-

Toho Company (Japan) $1.6 billion

-

PBL (Australia) $750 million

-

TVB International (China)

-

Chinese Entertainment Television (China)

-

Asia Broadcasting and Communica-tions Network (Thailand)

-

ABS-CBN (Philippines)

-

Doordarshan (India)

-

Chinese Central Television (China)

[1] Katharine Graham, Washington Post owner, speaking at CIA’s Langley, Virginia headquarters in 1988, as reported in Regardie’s Magazine, January, 1990. Quoted from David McGowan, Derailing Democracy, (Common Courage Press, 2000), p.109.

[2] Ben H. Bagdikian, The Media Monopoly, Sixth Edition, (Beacon Press, 2000),

[3] Time, 28th February 2005

[4] Guardian, 28th April 1998

[5] Samuel Huntingdon, ‘The Clash of Civilisations and the remaking of the world order’